Discover exclusive insights from our latest study on the quick-service restaurant (QSR) market and its consumers. In this article, we explore key trends across pizza, burger, and sandwich chains, revealing opportunities for innovation to better meet consumer tastes, expectations and demands.

Key Consumer Insights

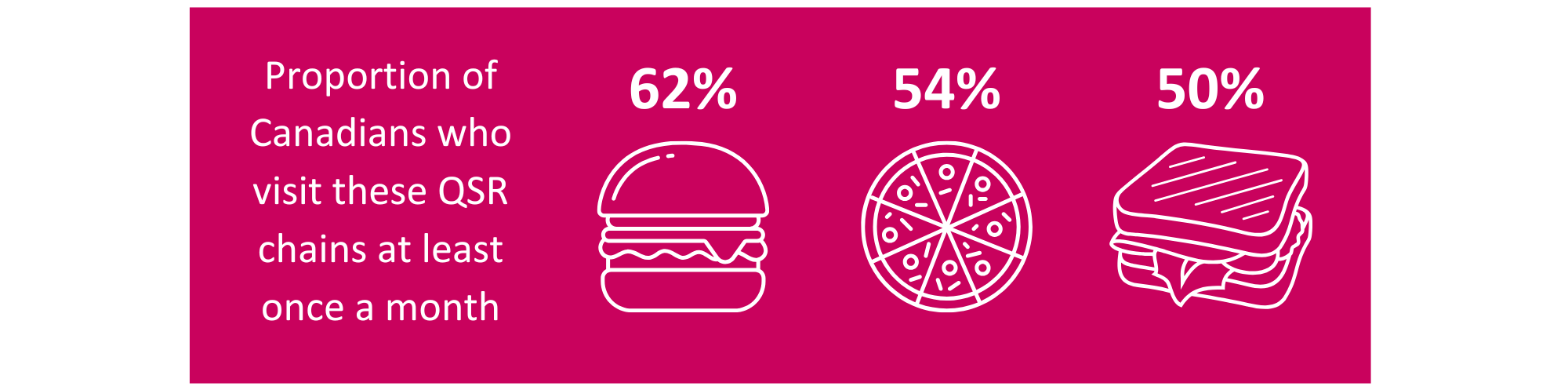

The QSR market in Canada is thriving, with many Canadians being frequent customers. In fact, more than three‑quarters of Canadians visit a quick‑service restaurant at least once a month, whether on‑site, takeout or delivery. Furthermore, burger chains are the most frequently visited, followed by pizza and sandwich chains.

On average, 57% of customers prefer takeout, compared to 24% who dine in and 19% who opt for delivery.

When choosing a QSR, customers consider several factors. Among the 25 criteria evaluated, good taste, affordable pricing and value for money stand out as the top priorities.

However, cost remains the main barrier for QSR visits, especially in the current inflationary context.

Impact of inflation on QSR visits

As inflation impacts daily spending, many Canadians are rethinking where and how they dine out. Consumer habits have shifted: people are now more likely to look for special offers, coupons, and discount codes, avoid extras or side dishes, and choose more affordable menu items.

59% of customers say they visit QSRs less often than before due to inflation, while 41% report visiting just as often or even more frequently.

QSR traffic still shows positive growth

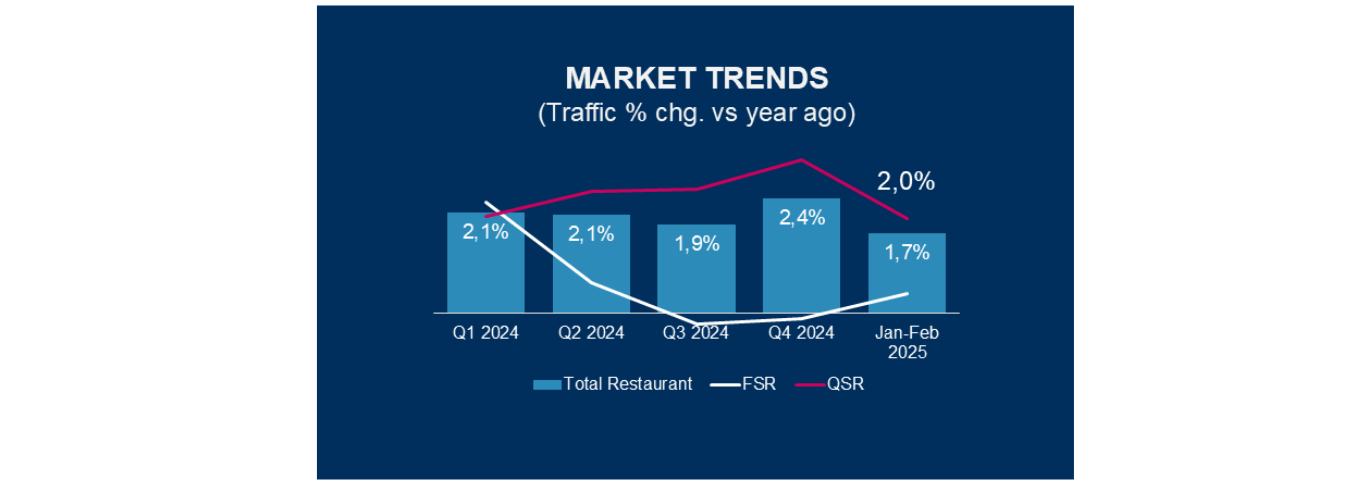

Since the onset of the inflationary period, consumers have shifted away from full‑service restaurants (FSR) in favour of more affordable options, allowing QSRs to maintain steady growth despite economic headwinds. From January to February 2025, QSR traffic increased by 2% compared to the same period last year. The overall foodservice industry grew by 1.7%, meaning QSRs are outpacing both full‑service restaurants and the broader market.

Source: Circana, CREST Report, January 2025

How to keep attracting customers

Even as customers become more budget‑conscious, there are still effective ways to encourage visits and remain attractive and competitive. According to surveyed customers, the following would encourage them to try new products or visit new QSRs:

- Coupon or promotions

- Limited-time offers

- New products

- Cause-related partnerships

- Social media trends

Cheese at the heart of QSR

Cheese plays a central role in QSR offerings. Nearly all quick‑service restaurant customers enjoy cheese (99%), with almost seven out of ten (69%) saying they like it a lot. Over half feel a strong attachment to cheese and say they would find it hard to live without it.

Let’s take a closer look at how cheese preferences and consumption drivers vary across key QSR categories.

Pizza chains

- Mozzarella is the number 1 preferred cheese, followed by Cheddar and Parmesan.

- About half of pizza chain customers enjoy cheese‑stuffed crust pizza, primarily for the taste.

- Here are the top 4 motivations for choosing QSR pizza chains:

- Quick service/Option

- Good taste/Quality

- Affordability/Value

- Convenience/Easy

Burger Chains

- Cheddar is the number 1 preferred cheese, followed by Mozzarella and Swiss cheese.

- 47% of the customers say processed cheese is a barrier to visiting a burger chain, indicating a preference for natural cheese.

- Here are the top 4 motivations for choosing QSR burger chains:

- Quick service/Option

- Good taste/Quality

- Convenience/Easy

- Affordability/Value

Sandwich Chains

- Cheddar is the number 1 preferred cheese, followed by Mozzarella and Swiss cheese.

- 67% prefer their cheese to be sliced, and 68% usually eat their sandwiches warm.

- Here are the top 4 motivations for QRS sandwich chains:

- Quick service/Option

- Convenience/Easy

- Healthy and Fresh Options

- Good taste/Quality

Conclusion:

Despite economic pressures, one thing is clear: cheese continues to drive consumer appeal. We are here to support your growth with the right cheese solutions, ideal formats and bold natural cheese types that elevate your menu and keep you ahead in the fast-paced world of quick-service.

Let’s grow together – reach out today and discover how we can help you stand out.

Source: Foodservice Usage & Attitude and segmentation study, 2024